Payment Tracking

Ottu dashboard is an intuitive workspace composed of a set of tools, to empower all Ottu clients to have a proper payment pipeline, create, monitor, and track payments, the dashboard greets clients with analytical information captured from payment workload(s), to give the client an insight about the payment pipeline and how could proceed with next-login.

All transaction history and details are easily accessible for merchants using Ottu's transaction table, which is provided with each plugin installed. Through the transaction table, users can proceed with payment operations such as void, refund, and capture.

The transaction table is located in the transaction tab under each installed plugin.

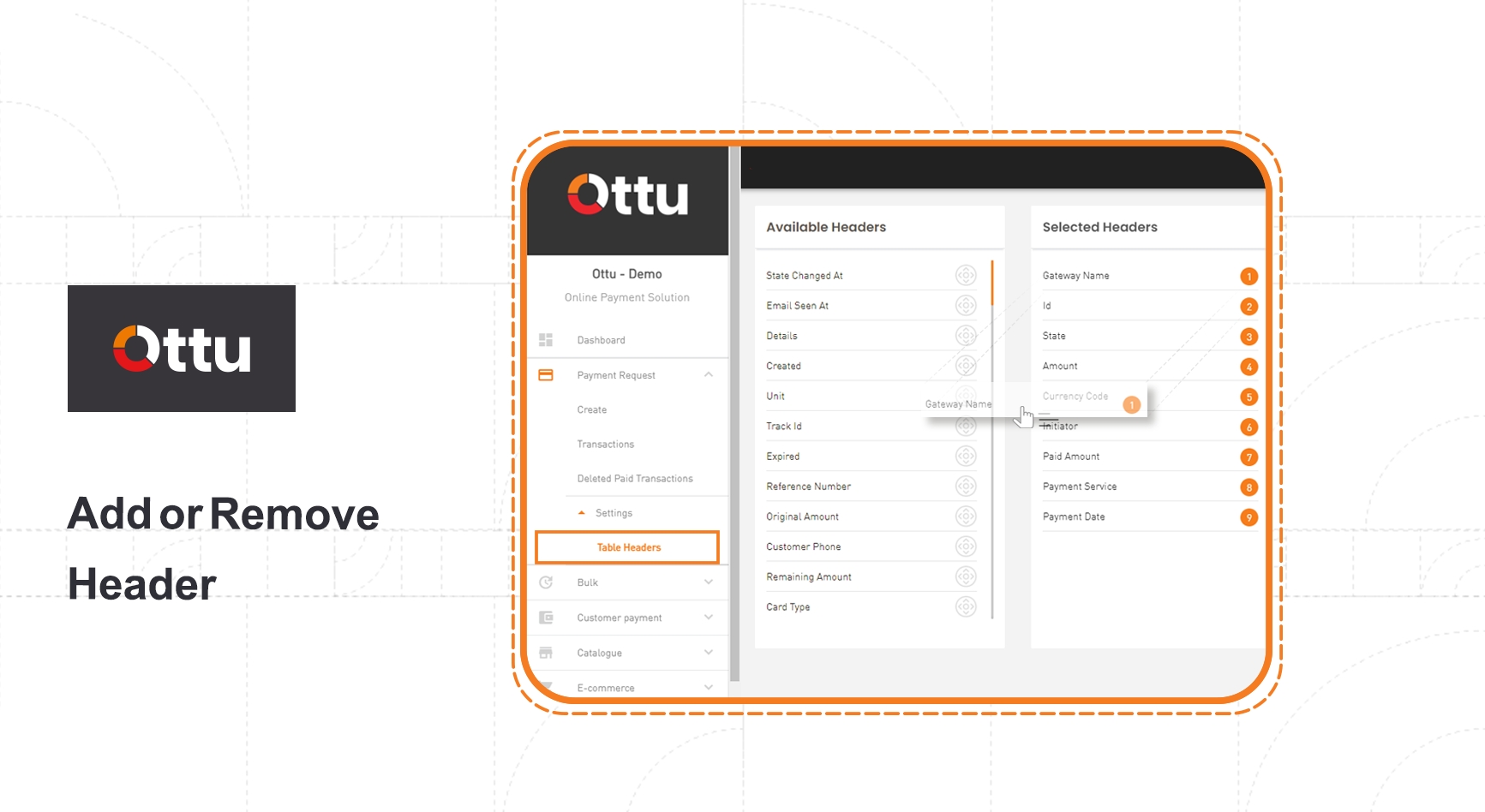

Ottu creates a transaction table for each plugin in order to allow merchant(s) to monitor their transactions. Ottu offers an amazing method of adding or removing transaction table’s headers, by using this method, the merchant(s) are empowered to find the required information quickly and easily.

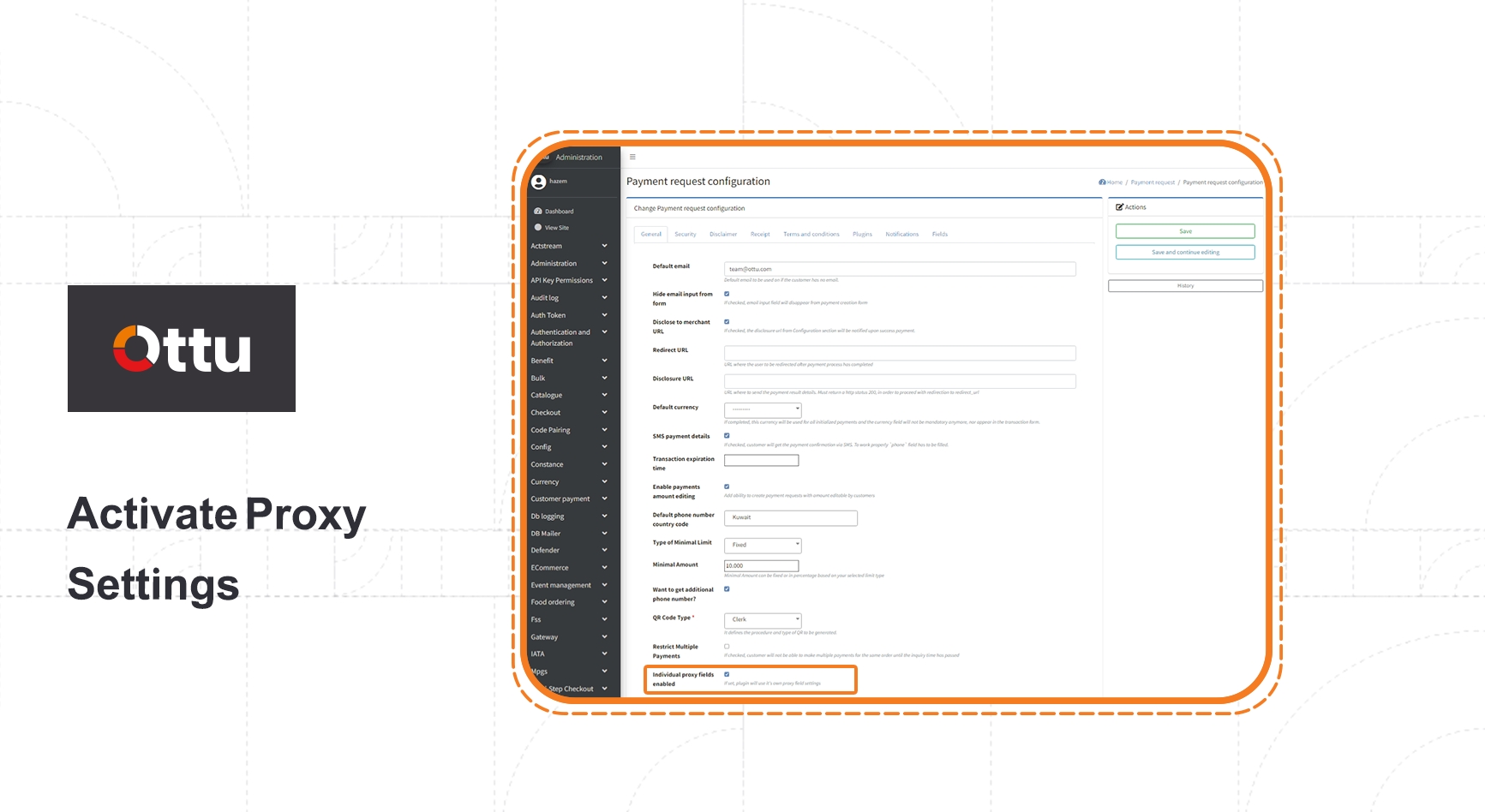

Ottu dashboard > administration panel> plugin config (the plugin of the targeted transaction table) >Tick on (Individual proxy fields enabled)

Ottu dashboard > Required Plugin Tab> Setting > Table headers By dragging the required header (right ⇆ left), the merchant(s) can add or remove the header.

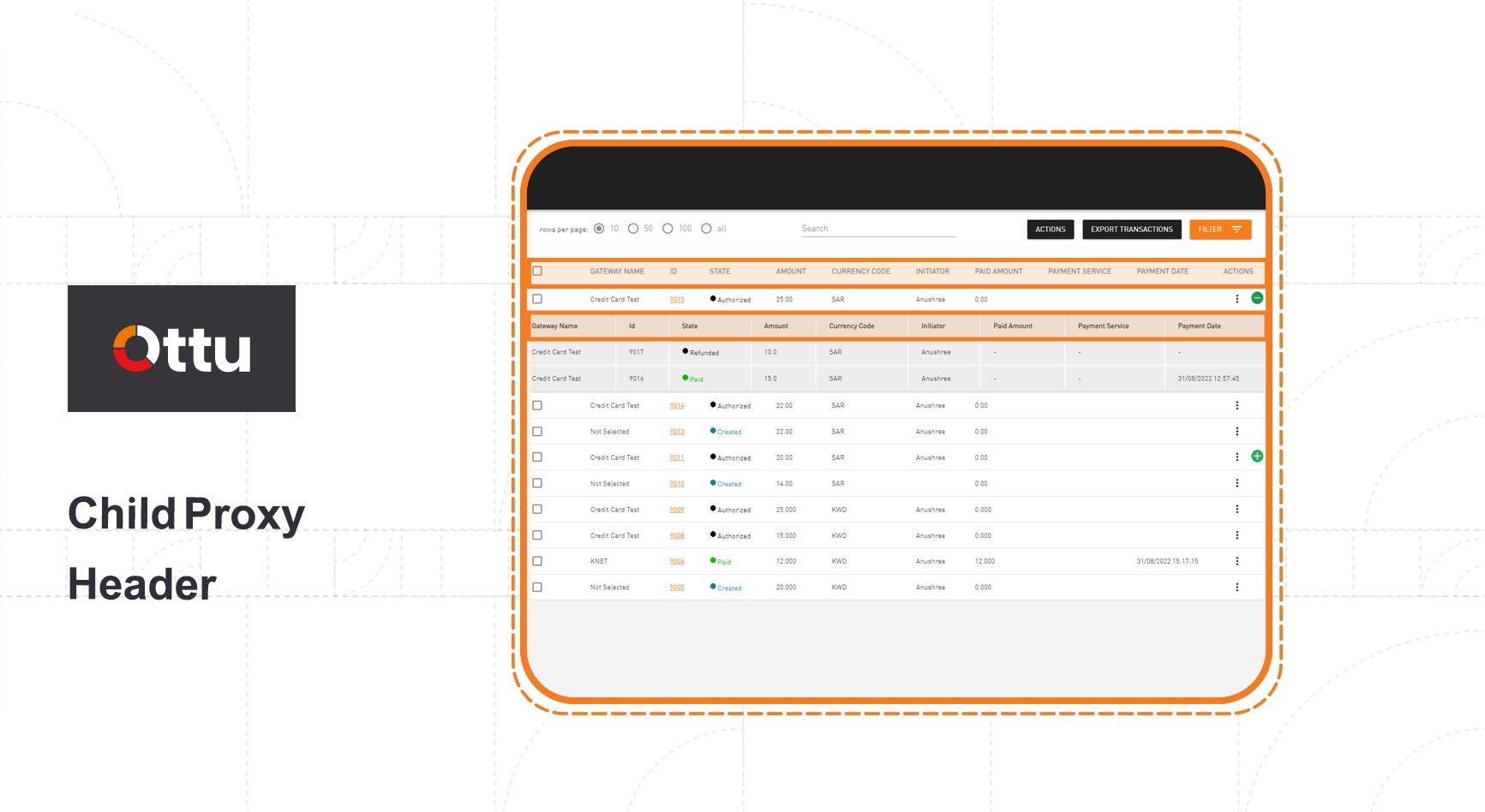

Child transactions are those created by subsequent operations (capture, refund, or void). They should be listed in the transaction table under the main origin payment transaction, which is called parent transaction. The headers of each child payment transaction are inherited from the headers of the parent payment transaction.

Many headers can be added / removed in transaction tables. See proxy fields Amount headers are displayed in different titles based on where the header refers to the payment amount in the process flow.

This is the initial amount at the creation of the transaction.

Is the amount with the same currency of the initiating amount,

For editable amount: It is the amount that the customer enters at the checkout page, If the customer pays the full required amount, it will have the same value as the initiating amount.

For non-editable amount: The settled amount is the same value as the initiating amount.

It is the amount that is credited to the merchant's bank account.

For purchase: It is a settled amount after adding the fee.

For authorize: Is the total amount captured by the staff.

Purchase or authorized is determined in payment gateway setting or configuration. See PG configuration.

|Amount - Settled amount|

It represents a markup amount on the initiating amount, which the customer proceeds with.

Depending on the selected merchant(s) currency configuration, which is used by the selected PG, fees may be applied or not to the transactions in the default currency or foreign currency.

The amount, which is sent back to customer's bank account, which is deducted from the paid amount.

It is the full transaction amount, which is credited to the customer's bank account, when the transaction rolling back process gets done. It works only for authorized payment, which is not fully or partially captured.

Capture, can capture the entire amount, fee + settled amount.

Refund, can only refund the settled amount, that’s without fee.

Void, will void the full amount, including the fee.

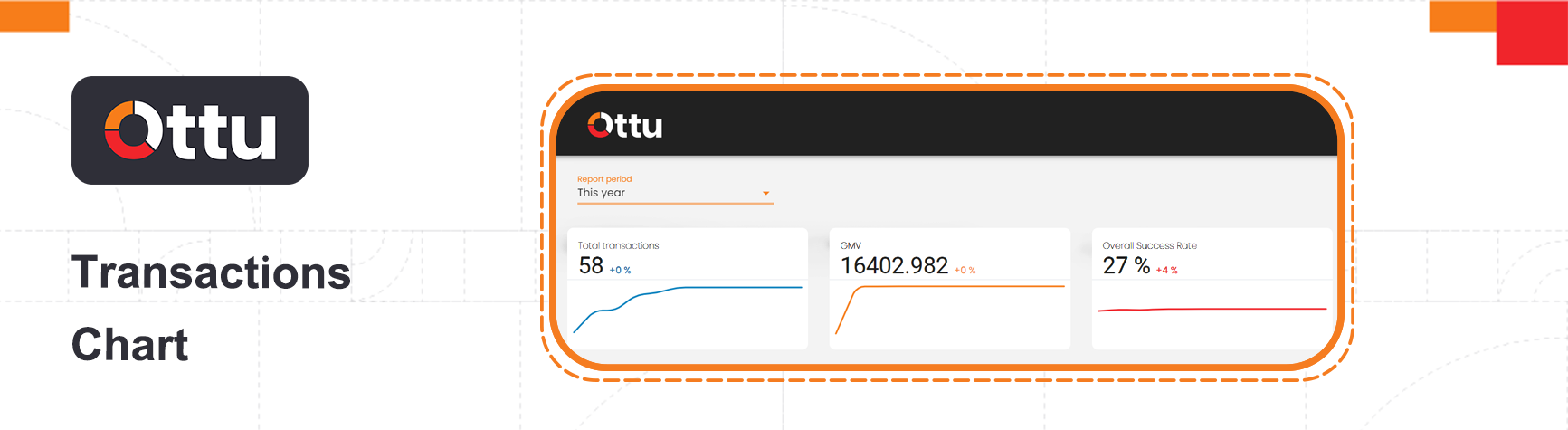

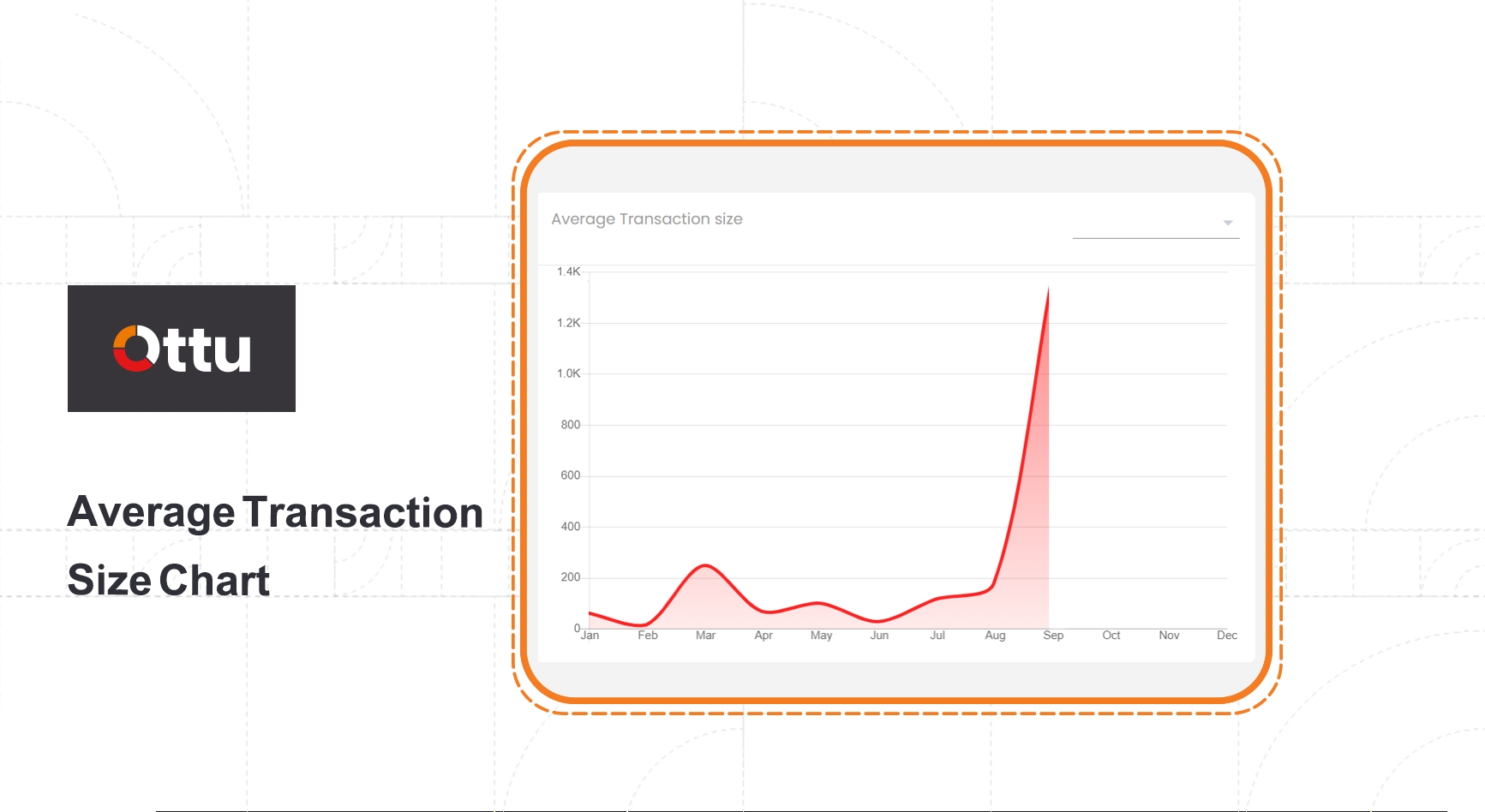

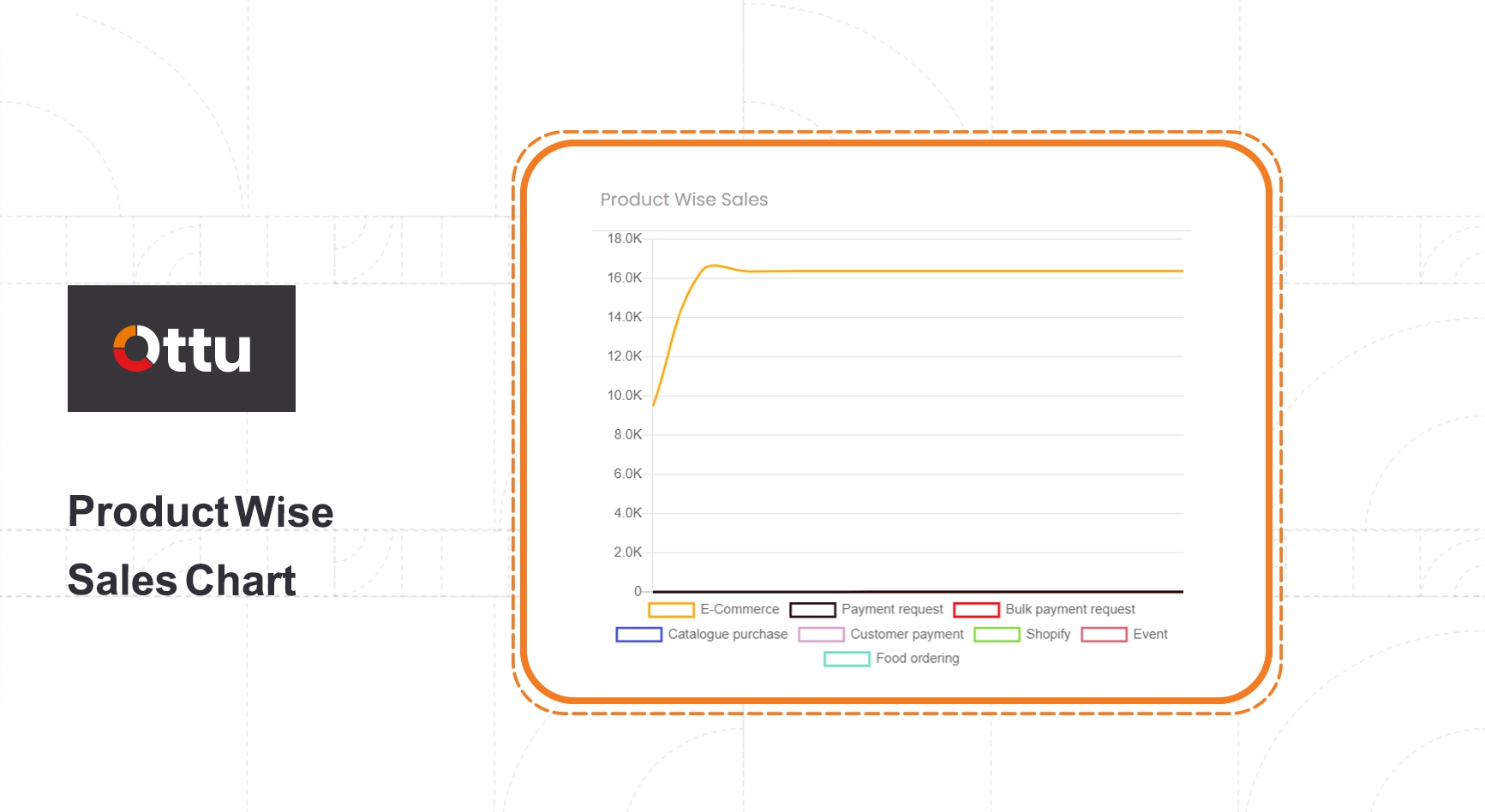

Merchant(s) easily track and monitor overall transactions and sales progress all in one place, the following snapshots have been taken from the dashboard showing a number of usable charts.

Represents gross volume and overall success rate across various periods.

Payment transaction is a core transactional data which is used by the merchant(s) to create a payment, and to perform certain operations like refund void, cancel .etc. Payment transaction is divided into two types.

Parent payment transaction: Holds the data about the payment.

Child payment transaction: Is created for subsequent operations triggered by the merchant(s).

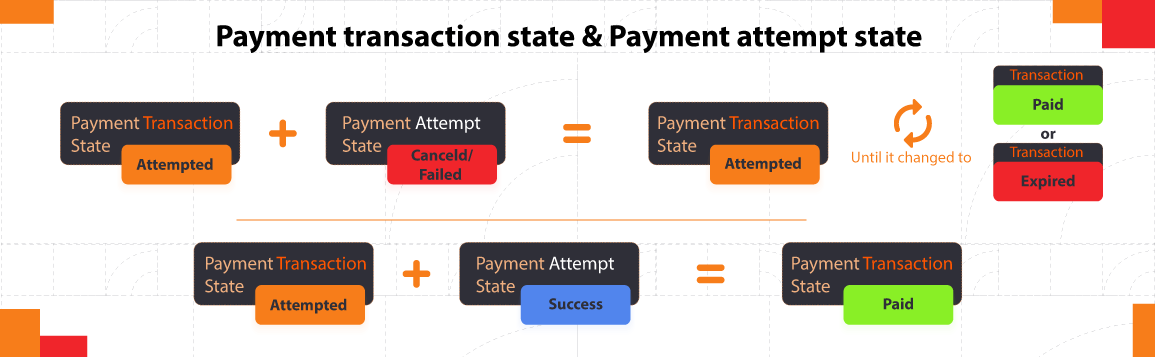

Payment transactions state are flags, which help merchant(s) to audit-trail the transaction process.

Below figure shows the payment transaction details which is having parent and child state for same payment transaction process. A. The full payment amount. B. Parent state (authorized). C. Child state (paid and refunded).

Payment attempt is the trial that the customer(s) make to proceed the payment when the payment transaction fails, and it is allowed to proceed multiple times.

Payment attempt state represents the payment state at the customer-end.

Payment transaction NOT allowed to be tried multiple times

It does not have an attempted state, it has either failed state or authorized state.

Ottu has implemented an event notification system, merchant(s) has the ability to choose the types of the notification event such as (Email, SMS, and WhatsApp).

It is the ability to shorten the URL to be sent by SMS in order to reduce SMS consumption. See URL shortener configuration.

The expiration time is the length of time within which a failed transaction can be processed again, and the payment can no longer be processed after the stipulated period has expired. By default, the expiration period is one hour.

Last updated